Nurture Our Future With a Planned Gift

Planned gifts allow donors to give as they are led based on the impact they want Pendle Hill to have. Donors can make choices about whether to give now or in the future, and what to give: cash, stock, IRAs, real estate, or other assets. If each of us contributes what we can, then we collectively nurture Pendle Hill as a community that transforms lives.

Planned gifts allow donors to give as they are led based on the impact they want Pendle Hill to have. Donors can make choices about whether to give now or in the future, and what to give: cash, stock, IRAs, real estate, or other assets. If each of us contributes what we can, then we collectively nurture Pendle Hill as a community that transforms lives.

Please contact our Annual Fund Officer at 610-566-4507, ext. 132 – or development@pendlehill.org – to learn more about the planned gifts summarized below, or if you have already planned a gift for Pendle Hill’s future.

Popular Ways To Give

For most of us, a gift made from our estate is the most generous charitable gift we can make. That is because during our lifetime we are free to use our assets for any purpose, and we can always revise our gift plan if circumstances change.

Bequest: A bequest is a gift made in your will. Bequests are the most popular way to nurture Pendle Hill’s future. It’s easy to make a bequest by including the following wording to your will or in an amendment called a codicil: “I give and bequeath to Pendle Hill, 338 Plush Mill Road, Wallingford, PA 19086, ($______ dollars) (a specific asset) or (___ percent of the rest, residue and remainder of my estate) to be used for its general purposes.”

Beneficiary Designations: Nurture Pendle Hill’s future by naming Pendle Hill as the beneficiary of a retirement plan or life insurance policy.

Retirement plans such as your traditional IRA, 401(k) or 403(b) are the most heavily taxed assets in your estate because they are subject to income and inheritance taxes when left to someone other than a spouse. Fortunately, it is easy to name Pendle Hill as beneficiary so that taxes are avoided. Complete a change of beneficiary form from your retirement plan provider to leave part or all of your retirement assets to Pendle Hill.

Naming Pendle Hill as the beneficiary of an existing life insurance policy is another way to nurture its future. Many people who bought life insurance years ago no longer have a financial need for life insurance protection. Now that their children are grown or the mortgage has been paid off, there may no longer be a need for life insurance. Contact your agent or the insurance company directly to obtain a change of beneficiary form.

Tax-Wise Ways To Give To Pendle Hill Today

IRA Charitable Rollover: If you are at least 70 ½ years of age, you may make gifts to Pendle Hill today that count toward your annual required minimum distribution and that are not included in your income. Therefore, you avoid income taxes on the amount donated directly to Pendle Hill by your IRA trustee. Note that this tax benefit is the same whether or not you itemize charitable donations on your federal income tax return.

Gifts of Assets: Gifts of assets that have increased in value such as stock, mutual funds, or real estate provide a double income tax benefit when you donate them to Pendle Hill. First, when you give appreciated assets that you have owned for longer than one year, the capital gains tax is eliminated. Second, your donation also qualifies for a federal income tax charitable deduction. Even if you no longer itemize charitable donations on your federal income tax return, you still enjoy the first benefit by eliminating the capital gain.

Charitable Lead Trust: For those with large estates, a charitable lead trust allows you to provide immediate support for Pendle Hill’s mission and transfer assets to heirs in the future with significantly reduced gift and estate taxes. At the end of the trust’s term, typically 20 years, the trust’s assets pass to your heirs free from gift and estate taxes. Charitable lead trusts may be administered by Friends Fiduciary Corporation or another trustee of your choice.

Gifts That Pay You Income Now And Nurture Pendle Hill Later

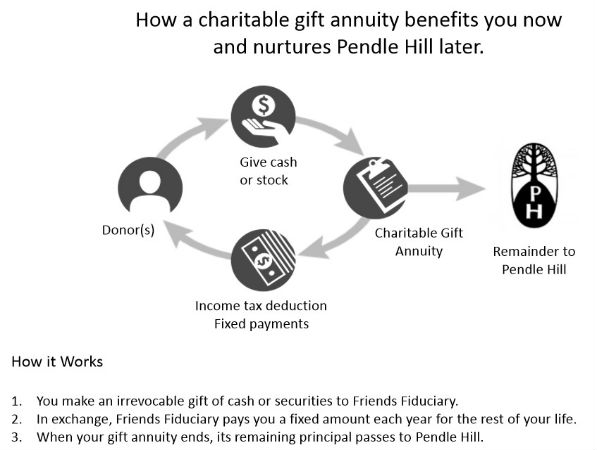

Charitable Gift Annuity: You, or someone you name, will receive a fixed annual income for life in exchange for a gift of cash or securities. This income may begin now or at a later date, such as retirement. The amount you receive is based on the age of the person receiving income, you or another person. Part of your income will be free from income tax and immediate capital gains are avoided if you make a gift of appreciated stock or mutual fund shares. Upon the death of the person receiving income from your gift Pendle Hill will use the remainder of your gift to fund programs that transform lives. Pendle Hill gift annuities are administered by Friends Fiduciary Corporation.

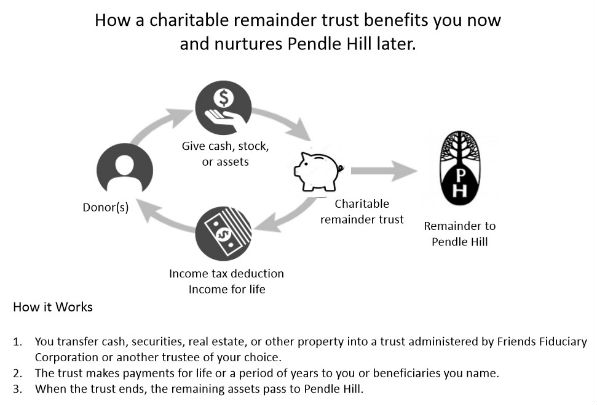

Charitable Remainder Trusts: Charitable remainder trusts permit you to create an income arrangement suited to your unique circumstances. For example, you may choose a fixed or fluctuating payment, the rate of income, and other features tailored to your needs. You incur no long-term capital gain tax on the transfer of appreciated securities or real estate into the trust. Upon the death of the person receiving the income from your trust, Pendle Hill will use the remainder of your gift to fund programs that transform lives. Charitable trusts may be administered by Friends Fiduciary Corporation or another trustee of your choice.

Join the Legacy Circle

The Legacy Circle recognizes those who have taken the special step of including Pendle Hill in their long-term plans with a bequest, a retirement plan or life insurance beneficiary designation, a life income plan such as a gift annuity or trust, and other estate related gifts.

This information is not legal, tax, financial planning, or other professional advice.

You are advised to seek appropriate advice from your advisor.